I always poke around my viewer on Sunday nights. This is what grabbed my attention tonight.

Here's the main headline....

NY TIMES: Ministers Approve Bailout of Ireland

By STEPHEN CASTLE and LIZ ALDERMAN

Published: November 28, 2010

BRUSSELS — Fighting to prevent an accelerating debt crisis from engulfing Portugal and Spain, Europe’s finance ministers approved an 85 billion euro bailout package for Ireland, while also agreeing for the first time to hold private investors accountable for losses in future crises, beginning in 2013.

With the European Union engaged in a high-stakes battle with financial markets, the move to include bondholders in any future debt restructuring represents an important milestone in the current crisis because the countries stood together on an issue that had caused sharp divisions in recent weeks.

The decision is aimed at ending uncertainty over future rules for the euro zone, made up of the 16 countries that use the euro. Some policy makers had said that a lack of clarity about what would happen when the current bailout provisions ended in 2013 was a contributing factor in the recent market turmoil that led Ireland to ask for aid and that now threatens other countries.

“Europe has shown again it won’t shun difficult decisions and will act swiftly, decisively and united to safeguard the financial stability now and in the future,” said Jan Kees de Jager, the Dutch finance minister, referring to both the Irish bailout and the new permanent rescue plan.

But the move represents a big gamble that the promise of clarity and stability will outweigh the anxiety of investors weighing the purchase of bonds from the Continent’s weaker economies.

But it remained unclear whether enough had been done to quell the fears of contagion gripping markets. Despite Ireland’s application a week ago for a bailout package, the markets have continued to threaten the stability of the euro, and yields on 10-year bonds climbed last week in Greece, Ireland, Portugal, Spain and Italy.

The euro gained in early Asian trading after the announcement, strengthening to $1.3296 on Monday compared with $1.3242 in late trading Friday in New York.

Excerpts from the Irish Department of Finance...

Announcement of joint EU - IMF Programme for Ireland

The

Government today agreed in principle to the provision of €85 billion of

financial support to Ireland by Member States of the European Union

through the European Financial Stability Fund (EFSF) and the European

Financial Stability Mechanism; bilateral loans from the UK, Sweden and

Denmark; and the International Monetary Fund’s (IMF) Extended Fund

Facility (EFF) on the basis of specified conditions.

The State’s contribution to the €85 billion facility will be €17½

billion, which will come from the National Pension Reserve Fund (NPRF)

and other domestic cash resources. This means that the extent of the

external assistance will be reduced to €67½ billion.

The facility will include up to €35 billion to support the banking

system; €10 billion for the immediate recapitalisation and the remaining

€25 billion will be provided on a contingency basis. Up to €50 billion

to cover the financing of the State. The funds in the facility will be

drawn down as necessary, although the amount will depend on the capital

requirements of the financial system and NTMA bond issuances during the

programme period.

If drawn down in total today, the combined annual average interest rate

would be of the order of 5.8% per annum. The rate will vary according to

the timing of the drawdown and market conditions.

Bank Restructuring and Reorganisation

The Programme for the Recovery of the Banking System will be an

intensification of the measures already adopted by the Government. The

programme provides for a fundamental downsizing and reorganisation of

the banking sector so it is proportionate to the size of the economy. It

will be capitalised to the highest international standards, and in a

position to return to normal market sources of funding.

Programme, Ireland will discontinue its financial assistance to the Loan Facility to Greece. This commitment would have amounted to approximately €1 billion up to the period to mid-2013.

MORE: IMF Reaches Staff-level Agreement with Ireland on €22.5 Billion Extended Fund Facility Arrangement

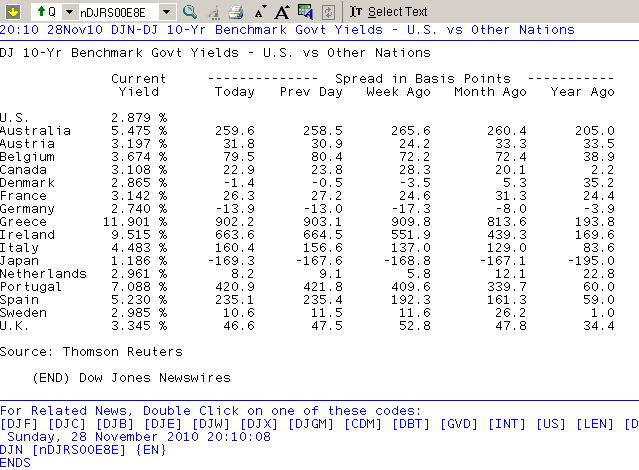

Here's global 10-yr note yields vs. the U.S. TSY benchmark. We're tighter to Ireland, Portugal, and Spain. Z-German's are stealing the spotlight from U.S 10yr notes. Directional moves and spread level shifts do grab the attention of U.S. investors. Especially the momentum crowd....

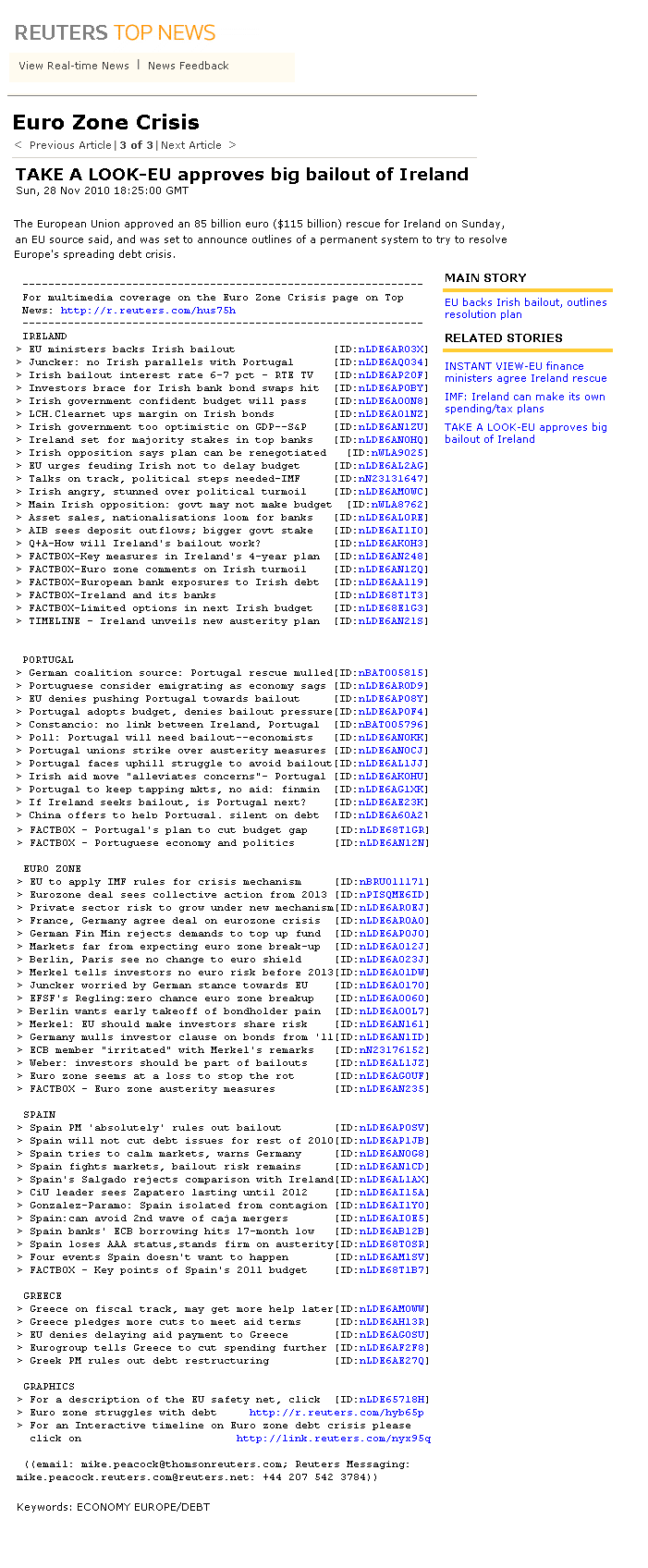

Here's a newswire headline recap on the EU Zone Crisis topic...

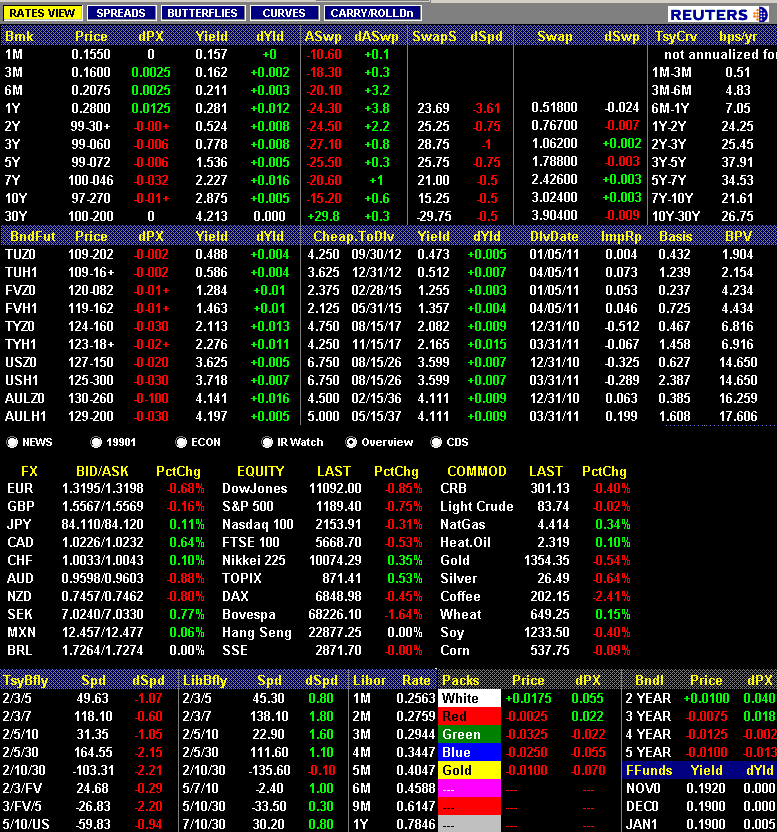

Here's how our markets look at the moment. S&Ps are +2.50 at 1185.75.

And here's to the trend channel we've been watching since early summer....

What Else?

U.S. politicians haven't made much noise lately...we should be expecting a little more biased chatter in the week ahead. POTENTIAL DISCUSSION TOPICS: Healthcare Repeal, Extending Bush tax cuts including cheaper capital gains tariffs for high income earners, Trade Balance-ing, Budget Cuts, Mortgage Servicing, and last but not least, the Federal Reserve.