Stocks initially sold to the lows of the week after Bernanke's speech flashed across wires but buyers were quick to take advantage of cheap prices. S&Ps have turned around and are now testing yesterday's session highs. The bond market is repricing as risk markets rally.

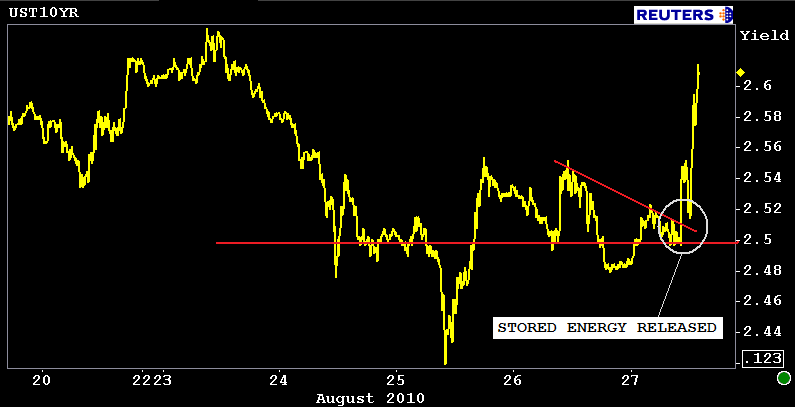

The 2s/10s yield curve is 11bps steeper as the 10-year TSY note has shed over 1 full point and is 13.2bps higher at 2.612%. After consolidating all week, stored energy has been released! Down volume is HUGE!

While mortgages are trading well relative to benchmarks, rate sheet influential MBS prices are still deep in the red. The FNCL 4.0 is -0-12 at 102-16 and the FNCL 4.5 is -0-09 at 104-06.

102-16 was the sell off target yesterday....

I know many lenders have delayed pricing but when they do publish, rebate will be worse. Others who released earlier in the day may reprice for the worse.

Now we wait for loan supply from lock desks......