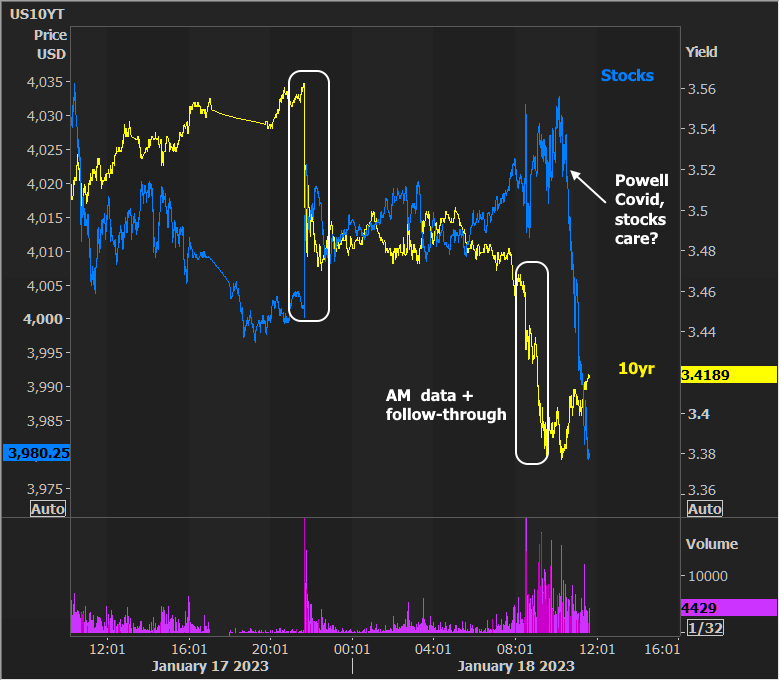

There was a fair amount of anticipation over the most recent policy announcement from the Bank of Japan (BOJ) which came out early in the overnight session. Markets expected another hawkish adjustment, but the BOJ held steady. 10yr yields rallied an instant 9 bps. The domestic session added to gains in early trading after the 830am data (Retail Sales declined more than expected and producer prices were revised slightly lower). Momentum and additional data at 9:15 (industrial production) added to the gains, but a bounce is underway as the PM hours approach.

The bounce is far more prominent in stocks, and it happens to coincide with newswires regarding a covid diagnosis for Fed Chair Powell.

The volume profile in the stock move (not pictured) suggests there was not one big reaction to one big piece of news. In other words, correlation may not imply causality in this case. We could also consider some hawkish comments from Fed speakers and layoff announcements from Microsoft that came out in the same general time frame. Combine that all with an initial rally reaction that ran out of steam in the 930am-10am time frame, and we probably don't need to read too much into the stock losses. Incidentally, we'd care more if bonds weren't still holding so much of the AM gains.