The relationship between stocks and bonds is much more complicated than most people assume. Conventional wisdom holds that stock prices and bond yields correlate with each other, but never forget:

To make matters more confusing, despite the INVERSE relationship over the longer run, there are definitely pockets of time where investors are moving money out of stocks, into bonds, and vice versa. This week hasn't been flawless in that regard, but it has generally seen more of that conventional wisdom type of movement. That was a good thing until last night when stocks finally embarked on their big bounce attempt for the week.

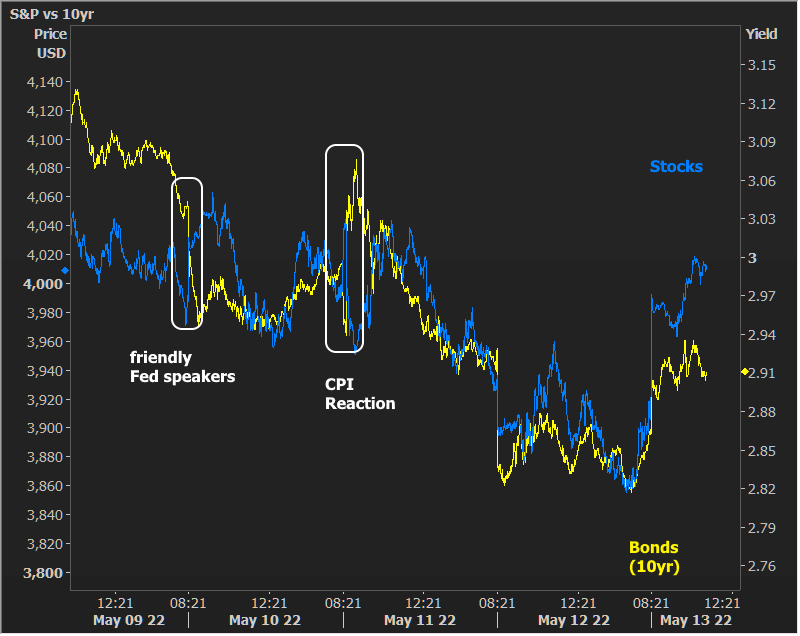

As the highlighted portions of the chart point out, even when the short term "conventional wisdom" trend is intact, there can still be pockets of different behavior. Sometimes this is a factor of earnings or Treasury auctions, but the most glaring example (and the one that almost always results in a perfect mirror image of stock prices and bond yields) is when the financial market is reacting to changes in the outlook for Fed policy. That was the case on Tuesday morning as Bostic helped moderate the view of the Fed's policy path and then again on Wednesday in response to hotter CPI data (which has direct implications for Fed policy).

Today's bounce in stocks is more technical, without any clear connections to data or events. Bond analysts are in broad agreement that stock gains are behind today's selling pressure. From here, it just remains to be seen how faithfully bonds are willing to follow.