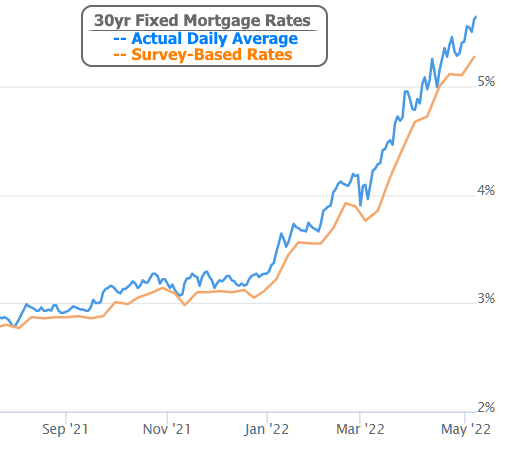

It was yet another tough week for the mortgage market with rates rising to their highest levels since 2009, but how high have they actually risen?

There’s a correct answer and then there’s the answer that can be gleaned from widespread media coverage of Freddie Mac’s weekly mortgage rate survey. As is often the case during times of heightened volatility, survey-based rates tend to lag behind reality.

On a positive note, Freddie correctly identified a large uptick in rates as well as their status as the “highest since 2009.” Unfortunately, the survey continues lagging behind the average lender based on an objective review of actual rate sheets. Whereas Freddie moved up to 5.27%, most lenders are at least a quarter of a point higher.

This doesn’t mean Freddie is “wrong” when it comes to rates. The survey is just limited in terms of what it can tell us regarding same-day availability of rates in a rapidly changing environment. Over longer time horizons and for the purpose of getting a general sense of how rates have been moving, the survey serves its purpose.

The other potential complication is that Freddie’s survey has another cost component that isn’t captured in headlines. In addition to the rate itself, “points” are also included. 1 point = 1% of the loan balance, paid upfront in order to obtain a lower interest rate. The rate reducing power of a point can vary over time, but at the moment, 1 point is generally worth at least 0.25% in rate. For instance, a rate of 5.25% with 1 point is roughly the same as a rate of 5.5% with no points.

While it’s great that Freddie also publishes points, the unfortunate reality is that media headlines and consumers tend to focus on the rate itself.

Are people really paying extra points on mortgages right now? Aren’t points “bad?”

There’s an old, popular, and oftentimes valid idea that you shouldn’t pay extra points for a mortgage. It’s especially valid when rates are broadly trending lower or if there’s any other reason a homeowner expects to sell or refinance in the foreseeable near-term future. You’d have to hold on to that mortgage for a certain amount of time before the monthly payment savings offset the additional upfront cost. There’s also the question of what else could be done with the money today that might benefit your personal balance sheet more than a modest reduction in monthly payment (i.e. paying off other debt, adding to investments, etc.).

The fact of the matter is that points are almost always simply a choice between paying upfront versus paying over time. More often than not, it was easier to make a case for not paying points during most of the past 40 years. In many cases that’s still true, but at the moment, points can’t be avoided in certain scenarios!

Why do certain scenarios require “points” right now?

Whether or not a loan quote actually shows “points,” there’s always an interest rate and an upfront cost associated with any loan. For instance, if your lender sells your loan, the rate of the loan will determine the price the lender receives. Higher rates mean higher monthly payments, so banks that buy loans are willing to pay more for those upfront. Incidentally, this is why you, as a consumer, can pay less upfront when you opt for the higher rate–because the bank that’s ultimately buying your loan (“the investor”) will cover the cost you would otherwise have paid in the form of upfront points. Your lender gets it either way.

Here’s the issue right now though: due to market volatility and the speed with which rates have risen, investors simply aren’t paying up for higher rates. It always takes some time for the market for higher rates to become active after fast spikes and 2022 has been the fastest spike in decades. Additionally, any time rates are significantly higher than they’ve been, lenders are concerned that today’s new mortgages will be refinanced very quickly as soon as rates fall.

Why would a lender not want you to refi too soon?

Remember the point (no pun intended) about each interest rate having an associated cost? In cases of higher rates, that cost structure means an investor might front $104,000 to buy a loan with a principal balance of $100,000. They would then need to keep that loan long enough to earn at least $4000 of interest just to break even because they will only receive the principal balance of $100k when the loan is refi’d or paid off.

Where this becomes particularly problematic is for certain loans that inherently carry big additional costs. Things like 2nd homes, investment properties, lower FICO scores and higher loan-to-value ratios can quickly rack up several points in additional costs that have to be absorbed either by paying points upfront or by higher interest rates. During more normal times, those higher rates would allow the investor to cover those additional costs. At present, investors aren’t offering much of a premium for higher rates. That leaves borrowers with only one option of paying those points upfront.

Why is all this happening?

Quite simply, the market continues adjusting to a new reality where the Federal Reserve (aka “the Fed”) is rapidly removing the rate-friendly punchbowl of monetary policy that’s been in place since the start of the pandemic. This is a topic we’ve covered fairly extensively in recent newsletters, so there’s no need to belabor the point. Here are links to the last two examples:

The Fed's Playbook is Already Out For Next Week

Mortgage Rates Are a Bit Higher (And Way Lower) Than You've Been Told

This week essentially brought more of the same with the Fed confirming all of the market’s fears about the pace of rate hikes and the winding down of the Fed’s bond buying efforts. NOTE: Wednesday’s Fed rate hike has NOTHING to do with this week’s mortgage rate movement. That rate hike was priced into the market months ago. Markets were more interested in the official announcement of the Fed’s balance sheet normalization. This was also widely expected, but the details weren’t fully confirmed. Bottom line: this week’s rate volatility was the byproduct of traders adjusting to the details of the normalization plan.