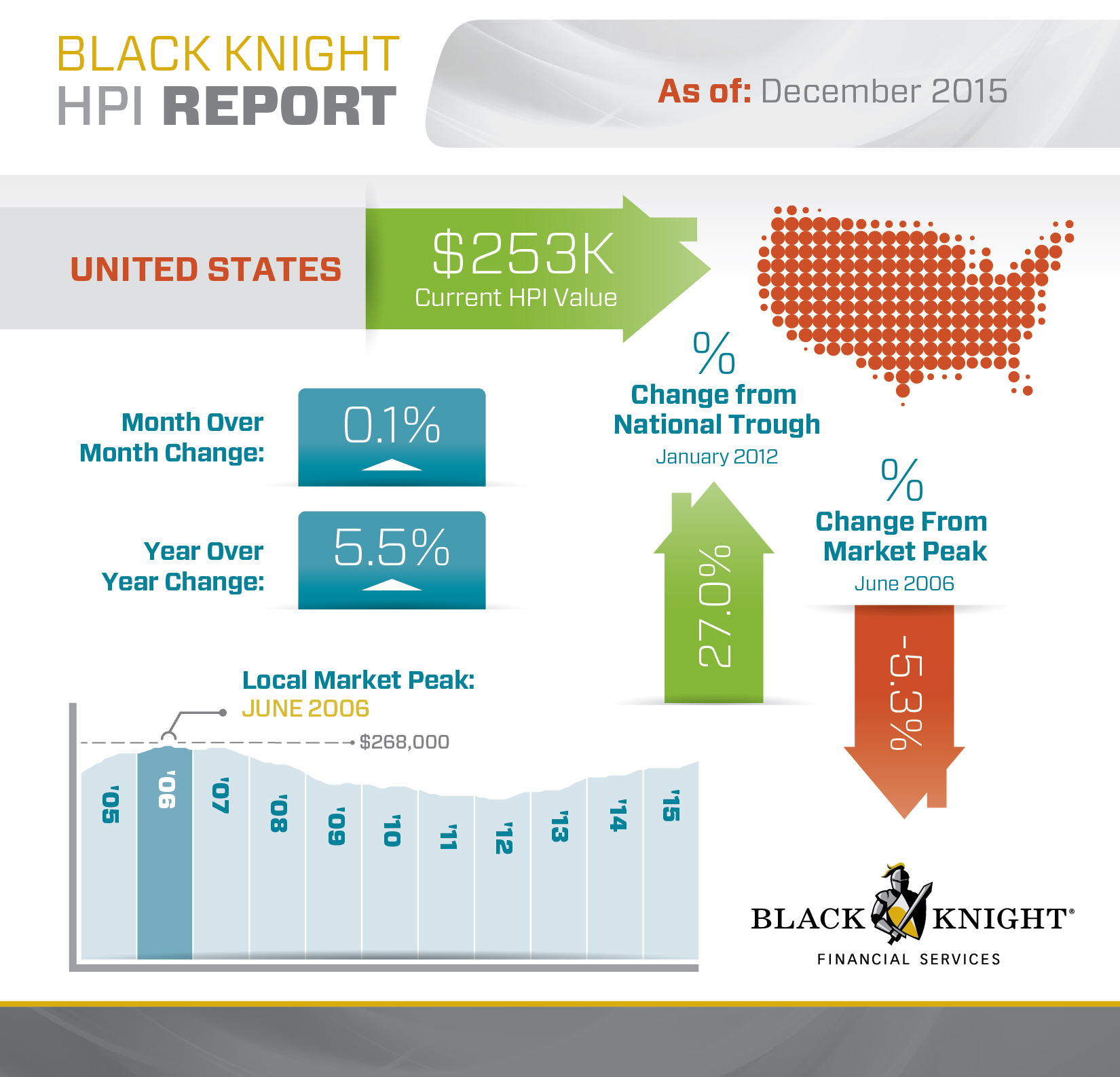

Home prices rose 0.1 percent in December according to Black Knight Financial Services. The company's Home Price Index (HPI) ended the month at $253,000 unchanged after rounding from the November number. The HPI was 5.5 percent higher than in December 2014 when it stood at $240,000.

Black Knight said its index has now risen 27 percent from the market bottom of $200,000 in January 2012 and is only 5.3 percent below its June 2006 peak of $268,000.

Florida and New York posted the largest gains among the states on a month-over-month basis, both increasing 8.0 percent. They were followed by five states with 4 percent changes, Washington, South Dakota, Arizona, North Dakota, and Wyoming. Both New York and Texas set new price peaks in December as did eight of the 40 largest metropolitan areas, four of them in Texas.

Florida accounted for all 10 of the top-performing metropolitan areas with increases ranging from 0.9 percent in Miami to 1.4 percent in Sarasota.

Connecticut again was the worst performing state, down 0.7 percent from November, and Michigan was second at -0.6 percent. Three states with -0.4 percent changes rounded out the top five, Louisiana, Virginia and Wisconsin. The most poorly performing metro areas were all in Connecticut and New Jersey ranging from Ocean City and Hartford at a month-over-month loss of 0.8 to Trenton at -1.1 percent.

The Black Knight HPI utilizes repeat sales data from the nation's largest public records data set, as well as its market-leading, loan-level mortgage performance data, to produce measures of home prices available for both disclosure and non-disclosure states. Non-disclosure states do not include property sales price information as part of their publicly available county recorder data. Black Knight is able to obtain the sales price information for these states by combining and matching records across its unique data assets.