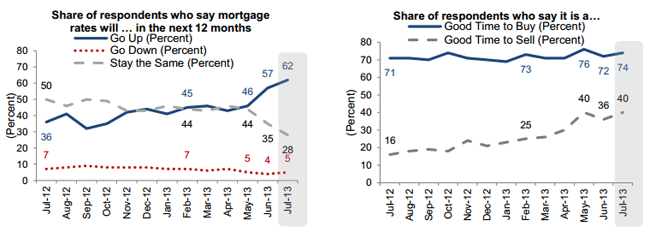

Consumers appear to take for granted that mortgage interest rates are going to rise. Only 5 percent of respondents to the July National Housing Survey expect rates to decline over the next year while 62 percent now believe they will rise, an increase of 5 percentage points from June and the highest level in the survey's three-year history. Nonetheless, 74 percent of those questioned in the Fannie Mae sponsored survey think it is a good time to buy a house while those thinking it is a good time to sell rose to 40 percent after dropping from that same survey high level in May to 36 percent in June.

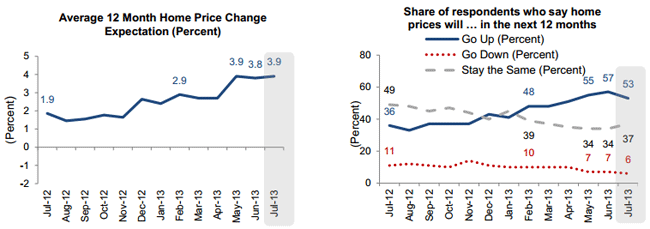

Fannie Mae said that overall consumer attitudes toward the housing market are increasingly positive. Consumers expect home prices to climb an average of 3.9 percent over the next 12 months even though those expecting any increase fell by 4 percentage points from the June survey high of 57 percent. Those expecting a decline in prices set a new survey low at 6 percent.

"Consumers have taken the interest rate rise in stride. Expectations for continued improvement in housing persist, and sentiment toward the current buying and selling environment is back on track from its dip last month," said Doug Duncan, senior vice president and chief economist at Fannie Mae. "These results are consistent with our own analysis of previous housing cycles, which finds that interest rates and home prices are not strongly correlated."

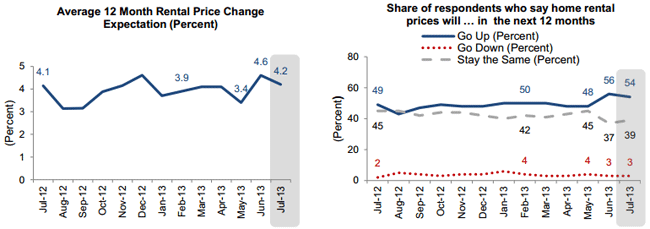

Respondents do expect some relief for renters. Fewer expect rents to increase over the next 12 months, dropping from 56 percent in June to 54 percent, and the average rent increase anticipated fell to 4.21 percent from 4.6 percent.

Americans are slightly less upbeat about home ownership, however. Only 45 percent feel it would be easy for them to obtain a home mortgage, down 2 percentage points, and there was a slight decrease to 64 percent of those who indicated they would buy if they were going to move.

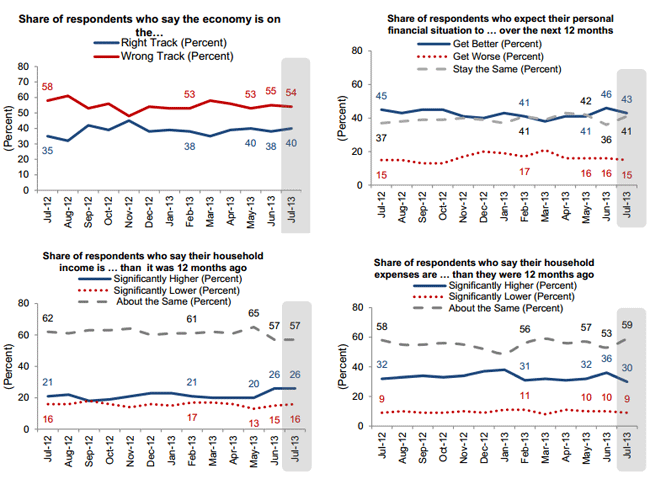

Three percent fewer people expect their personal financial situation to improve over the next year but the percentage of those reporting significantly higher household expenses fell from 36 percent to 30 percent.

Fannie Mae's survey is conducted monthly by phone with 1,000 homeowners and renters to assess their attitudes toward owning and/or renting a home, the economy, personal finances, and overall consumer confidence. The survey has been conducted monthly since June 2010 and the most recent round of questions took place between July 1 and July 20.