The phenomenon is very uneven geographically, but CoreLogic says that one factor behind the sustained pace of home price appreciation is the return of bidding wars.

The company's analysis is limited in that it was done on the city level in markets where there were a hundred or more closed home sale transactions in the second quarter - criteria that is in itself a bit self-defining. They also included properties where the sale price was bid up by $5,000 or more above the list. The cities that emerged on top for bidding wars were no surprise; they were mostly in the West and primarily in California, but some of CoreLogic's findings were still interesting.

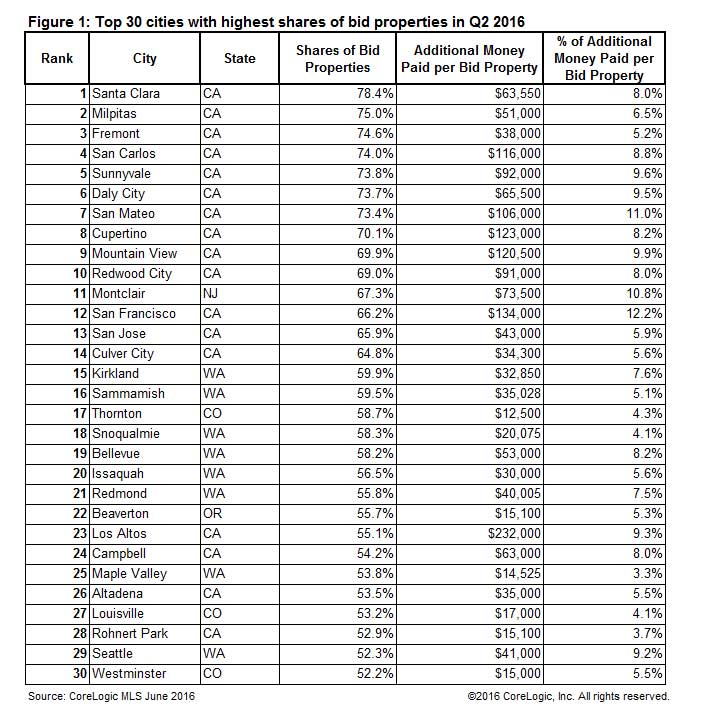

Seventeen of the top 30 cities where multiple offers are most frequently pushing home sale prices above list are in California, and eight are in Washington. And where they are occurring, bidding wars are not an isolated occurrence. Almost eight of ten properties sold in the second quarter in Santa Clara went above listing price; in two other California markets, Milpitas and Fremont, it was seven of ten. In each city falling in the top half of the list a minimum of 60 percent of sales were above the listing price and for the entire list bidding affected at least half of closed sales.

On a percentage basis, the largest average increase over listing price was in San Francisco at 12.2 percent followed by San Mateo at 11.0 percent and Montclair, New Jersey (the only market east of Colorado) at 10.8 percent. The low (keeping in mind the $5000 analysis floor) was 3.3 percent in Maple Valley, Washington. Given some already pricy markets, the extra dollars paid by buyers was impressive, ranging from a low of $12,500 in Thornton, Colorado to $232,000 in Los Altos, California.

CoreLogic Principal Economist Bin He, who wrote up the analysis for the company's Insights Blog said, "Let us pause for a moment and think about this: if you happen to get into a bidding war in San Francisco CA, which actually occurred in six out of ten closed sales in Q2 2016, you'd better be prepared to pay an additional $134,000 for your dream home."

So what is driving the bidding wars? He says it is that old villain, tight inventories. While they exist in much of the country, with an average of a 3.75-month supply of homes on the market nationwide, it follows that the inventory would likely be lower in those markets which also have the greatest demand. In California and Washington, the inventory is 2.6 months and 2.04 months respectively.

We are generally told that inventory is lowest in the bottom tier of home prices. It would be interesting to see CoreLogic repeat this analysis with a lower floor for the list price/ceiling price relationship. It might add yet another layer to discussions about the missing first-time homebuyer.