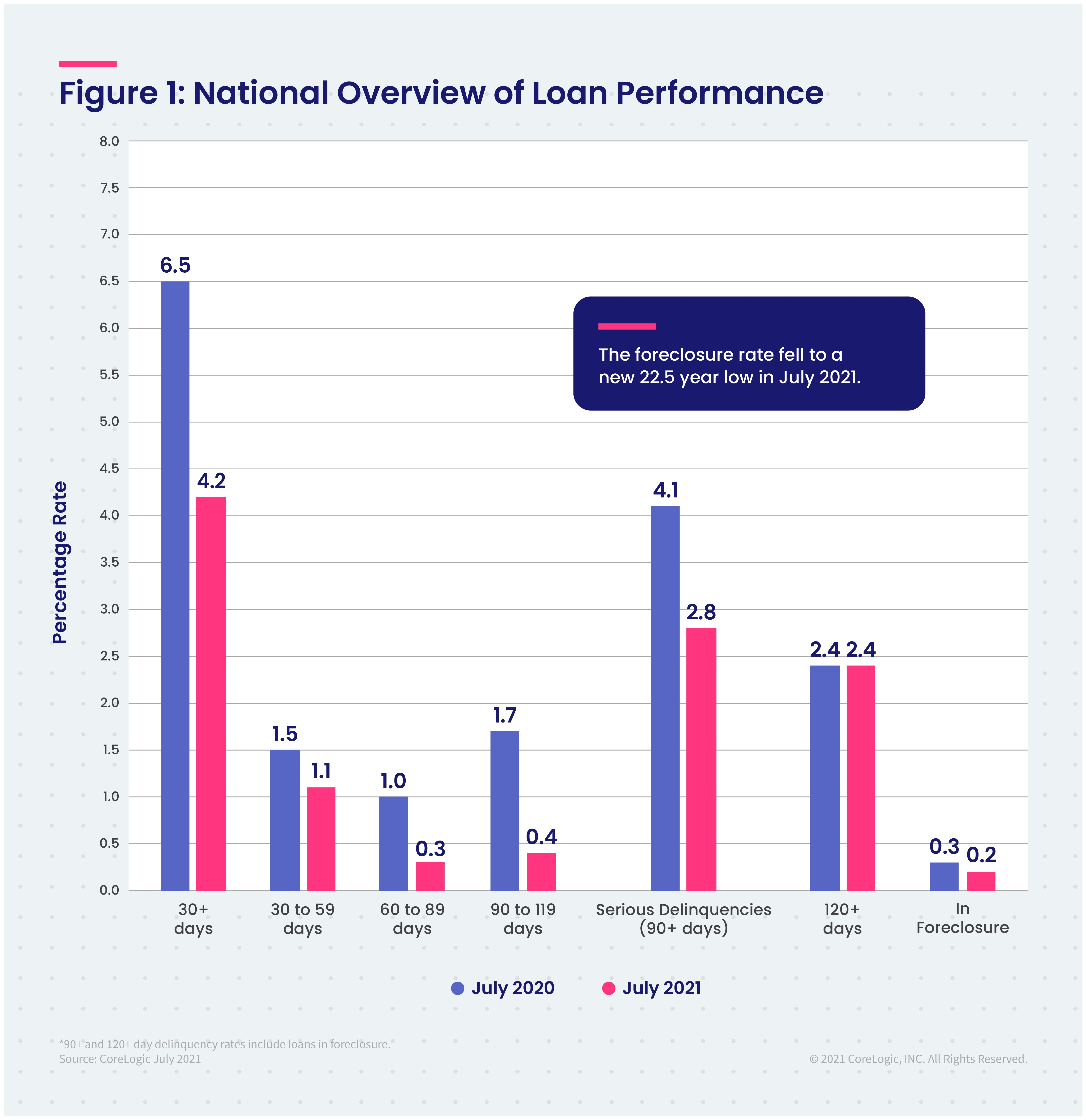

While the company estimates that about one million homeowners have not made a monthly mortgage payment in more than a year, CoreLogic says conventional measures of delinquency continue to retreat from pandemic highs. The national delinquency rate, the percentage of home mortgages that were 30 or more days past due in July, including those in foreclosure, was 4.2 percent. The previous July the rate was 6.5 percent and in February 2020, the month before COVID-19 hit the U.S., the rate was 3.6 percent.

Early stage delinquencies, those 30 to 59 days past due, were at a rate of 1.1 percent in July, an annual decline of 0.4 percentage point. The rate of adverse delinquency, loans 60 to 89 days in arrears, declined from 1.0 percent in July 2020 to 0.3 percent. Serious delinquencies, loans 90 or more days past due, including those in foreclosure, dropped from 4.1 percent to 2.8 percent. CoreLogic says the serious delinquency rate, while still elevated, is the lowest since May 2020.

The foreclosure inventory rate, the percentage of loans in process of foreclosure, dropped to 0.2 percent, the lowest level in CoreLogic's records which date to 1999. However, the federal moratorium on foreclosures was still in effect during the month. It expired on July 31.

During July, 0.6 percent of all mortgages that were current in June transitioned to a 30-day past due status. The transition rate in July 2020 was 0.8 percent.

While one million homeowners have not made a mortgage payment in 12 months, CoreLogic says about half of the nation's delinquencies are borrowers who are six months or more past due. Many of these are still leaning on options such as forbearance, loan modifications and other government provisions to keep from entering foreclosure.

"Even if loan modification or income recovery is unable to help delinquent homeowners become and remain current on their payments, the double-digit rise in home prices may help them avoid a distressed sale," said Dr. Frank Nothaft, chief economist at CoreLogic. "Homeowners with substantial home equity are far less likely to experience a foreclosure sale, and fortunately, the CoreLogic Home Equity Report found the average owner gained $51,500 in equity in the past year - a five-fold annual increase."

Delinquencies decreased in every state in July, led by New Jersey with a 3.9 point annual decline. Florida saw overall delinquencies down 3.5 points and Nevada's rate fell 3.3 points.