Large burdens of student debt have been blamed by many for the delay in homebuying that has characterized the Millennial generation. In a recent post on CoreLogic’s Insights blog Director of Analytics, Jianiun Xie, looks at the effect of this debt on Millennials’ creditworthiness.

Xie analyzed data from CoreLogic’s proprietary tenant scoring tool which is designed to measure the likelihood that renters will default on a lease within 12 to 18 months of applying to rent. The tool uses the applicant’s credit history from credit bureaus as well as specific rental application characteristics and has a scoring range of 200 to 800 with the higher numbers indicating higher credit quality. He looked specifically at prospective tenants aged 20 to 34.

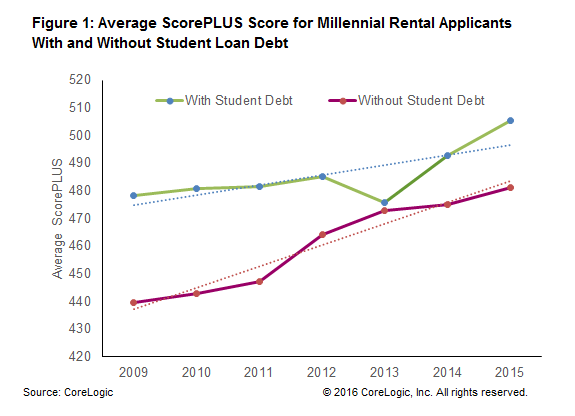

He first compared the average tenant scores over a six-year period, 2009 to 2015, for applicants who had student debt with those who did not. Those applicants with student debt actually had higher scores that those who were debt free. Xie said that applicants with student debt generally also held college degrees so “it is no surprise that these applicants had higher scores, on average, than those who did not have a college degree.” He noted that the score gap of the two groups has narrowed in recent years.

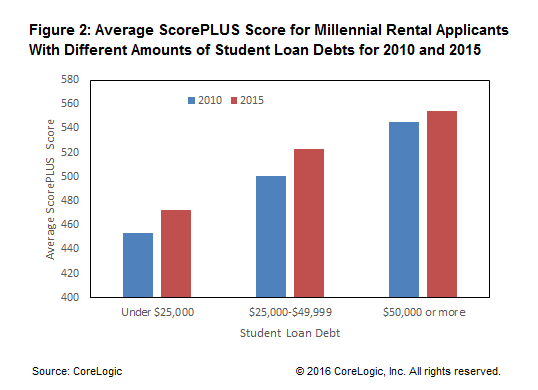

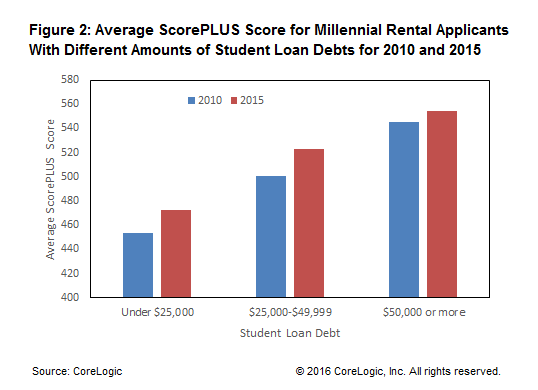

CoreLogic also compared renters’ scores among applicants with different levels of student debt. Figure 2 indicates that in both 2010 and 2015 those with higher debt levels also had higher average scores. This pattern was true as well for FICO scores.

Xie concludes that, despite the fact that student loans have become a major source of consumer debt, second only to mortgages, and created a significant financial burden for millennials, it does not appear to prevent millennials from accessing credit.