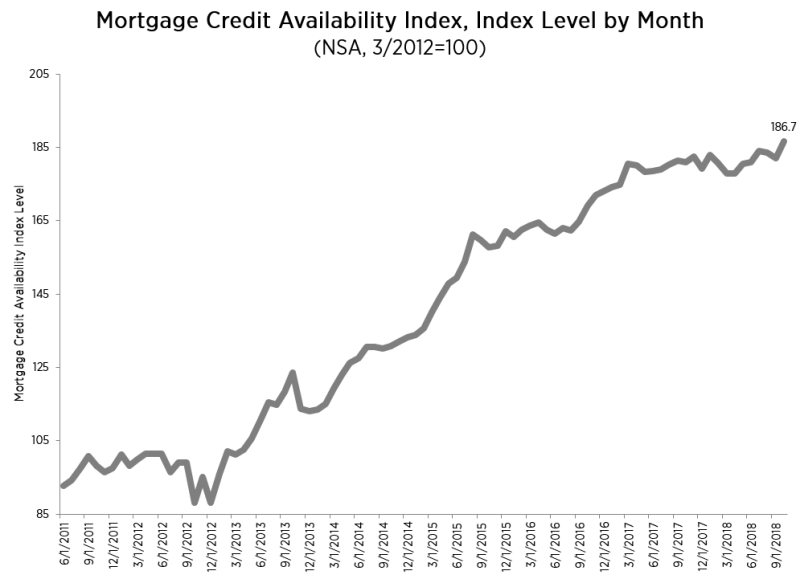

The ease of access to mortgage credit rose in October according to the Mortgage Credit Availability Index. An increase in the Index, a product of the Mortgage Bankers Association (MBA), indicates that credit standards are loosening while a decline is a sign that standards are tightening.

The 2.5 percent change in October took the composite index to 186.7. Among its components the Conventional MCAI, which itself is composed of two indices, gained 5.5 percent. One of its sub-measures, the Jumbo MCAI, surged by 6.3 percent while the other, the Conforming MCAI was 4.6 percent higher. Moderating the overall gains, the Government MCAI ticked down 0.4 percent.

"Credit availability increased in October, driven largely by an expansion in the supply of conventional credit, while government credit fell slightly over the month," said Joel Kan, MBA's associate vice president of economic and industry forecasting. "Reversing a trend from last month, lenders made more conventional and low down payment programs available to prospective borrowers. This increase in supply was likely in response to a growing number of first-time home buyers in the market, as home price appreciation has slowed and wage growth has picked up. Jumbo credit availability also expanded last month, with the jumbo index increasing again to its highest level since the survey began."

The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for over 95 lenders/investors are combined by MBA using data made available via the AllRegs® Market Clarity® product and a proprietary formula derived by MBA to calculate the MCAI, a summary measure which indicates the availability of mortgage credit at a point in time. The index was benchmarked to 100 in March 2012. The Conforming and Jumbo indices have the same "base levels" as the Total MCAI (March 2012=100), while the Conventional and Government indices have adjusted "base levels" in March 2012. MBA calibrated the Conventional and Government indices to better represent where each index might fall in March 2012 (the "base period") relative to the Total=100 benchmark.