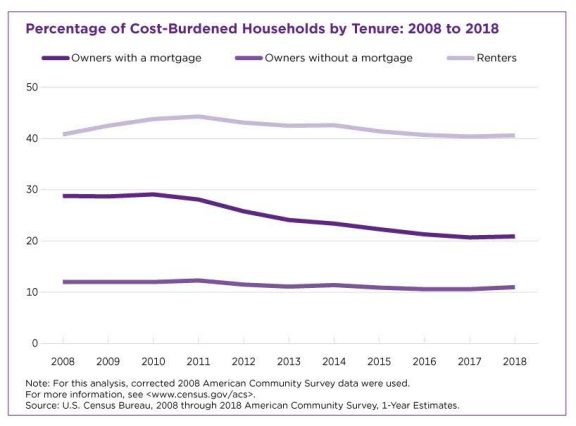

It may come as a surprise to some, but the Census Bureau says the housing cost burden for homeowners has been getting lighter. The Bureau's American Community Survey (ACS) found fewer households are carry excessive costs than before the recession, however the rate of renters with high housing cost has remained about the same.

A cost-burdened household is one that spends 35 percent or more of its monthly income on housing related expenses. For homeowners that includes not only mortgage payments but utility bills, property insurance and tax payments, and any required condo or mobile home fees.

The ACS found that, among the 77.7 million owner households in the country, about 62 percent had a mortgage, a share that has declined by 6.5 percentage points since 2008. In 2018, 20.9 percent of homeowners with a mortgage were cost burdened. Ten years earlier the survey found 28.8 percent of homeowners in that situation. Some households that were mortgage free were burdened as well, although it is a small number and has also declined since 2008, from 12.0 percent to 11.0 percent.

The picture wasn't quite as bright for the nation's 43.8 million renters. An estimated 40.6 percent of renter households spent 35 percent or more of their monthly household income on rent and utility bills last year. That's a dip of only 0.2 percentage points from 2008.

Census Bureau statistician Christopher Mazur says changes at the metro area level followed a similar trend as the nation as a whole. In 2008, there were 43 metro areas where at least 40 percent of homeowners with a mortgage were burdened. That had dropped to zero in 2018. Areas with more than 10 percent of non-mortgaged owners who were burdened fell from 85 metros to 53 over the same period. However, 81 metro areas reported that their burdened population of renters exceeded 40 percent in 2008. That has not changed.