According to Dr. Frank Nothaft, chief economist for CoreLogic, "Ten years ago, during the depths of the Great Recession, more than 11 million homeowners had negative equity." This was a quarter of mortgaged homes, he said. Times have certainly changed.

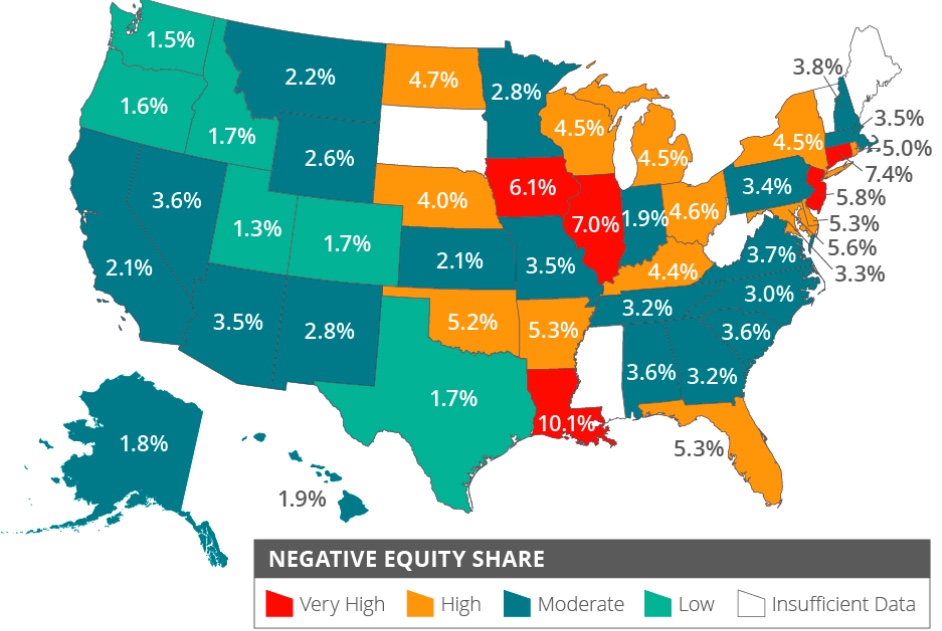

The third quarter report from CoreLogic on the equity in U.S. residential property shows only about 2 million homes to be underwater, with a higher balance on the mortgage or mortgages than the homes' value. This is 3.7 percent of all mortgaged properties.

The national aggregate value of negative equity was approximately $301 billion at the end of the third quarter of 2019. This is down quarter over quarter by approximately $2.4 billion, from $303.4 billion in the second quarter of 2019 and the number of homes affected was 220,000 fewer than a year earlier, a 10 percent decline.

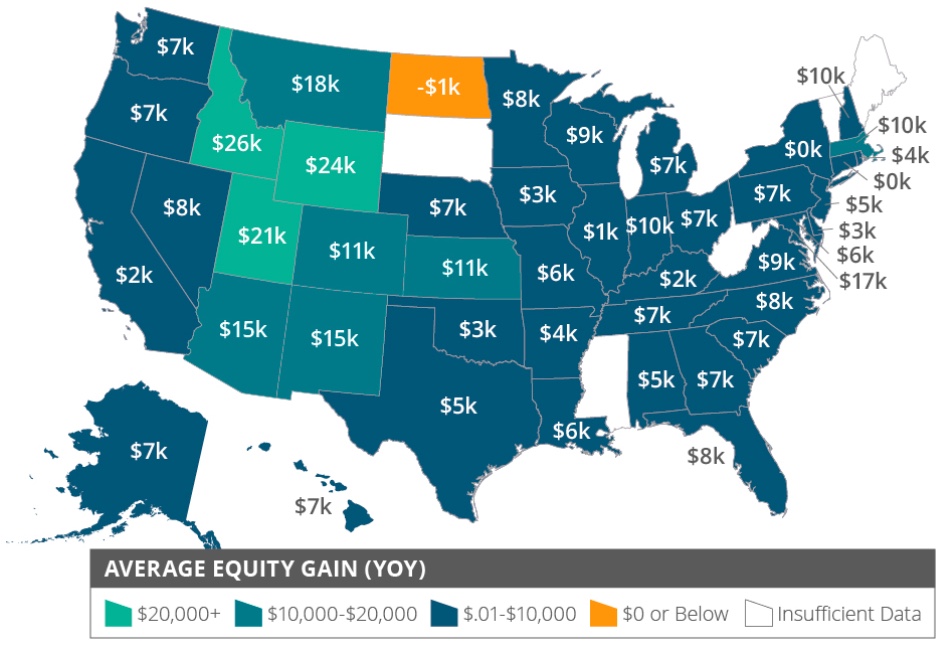

On the flip side, CoreLogic's analysis shows that equity in the 64 percent of all residential properties that carry a mortgage increased from the third quarter of 2018 to the most recent quarter by $457 billion, a 5.1 percent gain. The average homeowner gained approximately $5,300 in equity during the past year with Idaho having the highest year-over-year average increase at $25,800.

"The negative equity share continues to decline thanks to rising home prices across the nation," said Frank Martell, president and CEO of CoreLogic. "According to the latest HPI report, home prices increased an average of 3.5% year over year in October 2019. Out of all 50 states, homeowners in Idaho experienced the largest annual home price increase at 10.9%, while they also gained the most home equity, averaging $25,800."