- FNCL 45 -11 at 101-31

- Current Coupon:+7.5bps at 4.132%.

- MBS Yield Spreads Tighter In Busy Flows

- 10s: +11.5bps at 3.307%. 2s/10s: +8 at 245.Nothing Confirmed

- S&Ps: +21.25 at 1082.50. High print: 1092. Low print: 1055.50

- ECON DATA Mixed. Nothing New

- Stock Lever Sets Up Auction Concession But Yields Still Too Low

Good Morning. Today we celebrate the one year anniversary of "Black Wednesday"

"BLACK WEDNESDAY". A day when "rate sheet influential" MBS were sold by accounts of all types. Banks, Servicers, Pension Funds, Money Managers, and Hedge Funds...Real Money and Levered Accounts alike. After all was said and done, over $10bn in "current coupon" MBS was dumped by mortgage market participants. An amount not even the Federal Reserve could stand up to...

What a day that was....

Stocks rallied around the world in the overnight session

SHANGHAI: +1.15%

HANG SENG: +1.22%

TOPIX: +1.27%

NIKKEI: +1.23%

KOSPI: +1.60%

SENSEX: +1.70%

STRAITS: +1.62%

ASX: +1.67%

DAX: +2.24%

CAC: +2.04%

FTSE: +1.86%

Today we got the "PRELIMINARY" read on Q1 GDP. I say "PRELIMINARY" because this report will be revised one more time (and then some in the years to come). This is the "second" estimate for the first quarter, based on more complete data, the "Final" read will be released on June 25, 2010.

The market was expecting the second estimate of Q1 2010 GDP to print +3.4%. Actual was +3.0%.

The increase in real GDP in the first quarter primarily reflected

positive contributions from personal consumption expenditures (PCE),

private inventory investment, exports, and nonresidential fixed

investment that were partly offset by negative contributions from state

and local government spending and residential fixed investment.

Imports, which are a subtraction in the calculation of GDP, increased.

The

deceleration in real GDP in the first quarter primarily reflected

decelerations in private inventory investment and in exports, a downturn

in residential fixed investment, a larger decrease in state and local

government spending, and a deceleration in nonresidential fixed

investment that were partly offset by an acceleration in PCE and a

deceleration in imports.

Here is a summary of the results:

- PRELIM Q1 GDP +3.0 PCT (CONSENSUS +3.4), PREV +3.2 PCT;

- FINAL SALES +1.4 PCT (CONS +1.7), PREV +1.6 PCT

- PRELIM Q1 GDP DEFLATOR +1.1 PCT (CONS +0.9), PREV +0.9 PCT

- Q1 PCE PRICE INDEX +1.5 PCT (CONS +1.5), PREV +1.5 PCT; CORE PCE +0.6 PCT (CONS +0.6), PREV +0.6 PCT

- Q1 CONSUMER SPENDING +3.5 PCT (PREV +3.6 PCT); DURABLES +12.2 PCT (PREV +11.3 PCT)

- Q1 MARKET-BASED PCE PRICE INDEX +1.4 PCT (PREV +1.4 PCT), CORE +0.3 PCT (PREV +0.3 PCT)

- Q1 BUSINESS INVESTMENT +3.1 PCT (PREV +4.1 PCT), EQUIPMENT/SOFTWARE +12.7 PCT (PREV +13.4 PCT)

- Q1 HOME INVESTMENT -10.7 PCT (PREV -10.9 PCT), BUS. INVESTMENT IN STRUCTURES -15.3 PCT (PREV -14.0 PCT)

- Q1 EXPORTS +7.2 PCT (PREV +5.8 PCT), IMPORTS +10.4 PCT (PREV +8.9 PCT)

- Q1 YEAR-ON-YEAR PCE PRICE INDEX +2.0 PCT (PREV +2.0 PCT), CORE PCE +1.4 PCT (PREV +1.4 PCT)

- Q1 BUSINESS INVENTORY CHANGE +$33.9 BLN (PREV +$31.1 BLN)

- Q1 BUSINESS INVENTORY CHANGE ADDS 1.65 PERCENTAGE POINT TO GDP CHANGE

- Q1 STATE/LOCAL GOVERNMENT SPENDING -3.9 PCT,

Plain and Simple: This data doesn't offer much in the way of "newness". It was slightly worse than expected but not bad enough to warrant weaker stock valuations. Consumer spending was marked lower thanks to a decline in demand for services. Durable goods spending was however revised higher...that is a plus. Business investment in equipment and software dipped a bit more than most would've liked to see. Housing Investment "improved" from -10.9 to -10.7. State and Local Government spending saw its largest decline since 1981 (-7.4 PCT). I explained how this would erode your quality of life HERE.

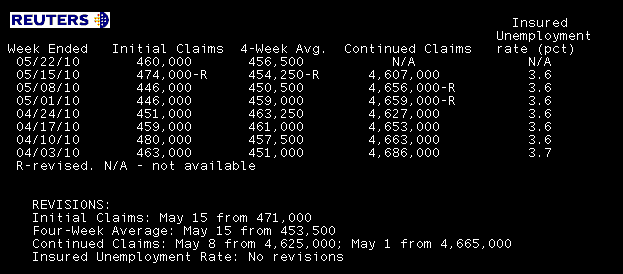

The DOL has released Jobless Claims data....

INITIAL JOBLESS CLAIMS: -14,000 TO 460,000 IN WEEK ENDING MAY 22 (CONS. 455,000). PREVIOUS WEEK REVISED TO 474,000 FROM 471,000. 4-WK AVG ROSE TO 456,500 MAY 22 WEEK FROM 454,250 PRIOR WK (PREV 453,500). NON SEASONALLY ADJUSTED -5,765 TO 404,325

CONTINUED CLAIMS: -49,000 TO 4,607,000 IN WEEK ENDING MAY 15 (CON. 4.62 MLN). PREVIOUS WEEK REVISED TO 4,656,000 FROM 4,625,000.NON SEASONALLY ADJUSTED -88,300 TO 4,381,421

EXTENDED BENEFITS:+38,693 TO 278,953 FROM 240,260

EMERGENCY CLAIMS: -41,403 TO 5,059,843 FROM 5,101,246

Plain and Simple: Claims didn't fall into the 300k handle and they didn't rise into the 500's. Pretty status quo for this data recently. Both reports were slightly worse than expected but well within the range of estimates.

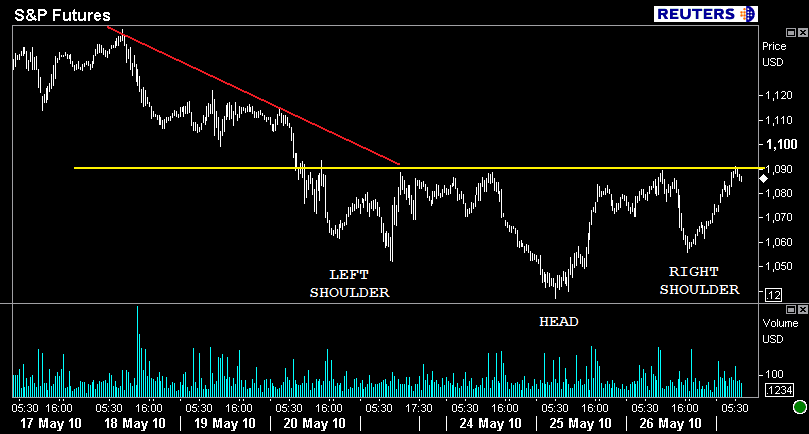

After the data S&P futures are up but off their session highs. ESc1 is currently +21.25 at 1082.50. High print: 1092. Low print: 1055.50. While there are some missing attributes and price action is indicative of day trading strategies...there is an inverted head and shoulders pattern in the making. High volume into updrafts supports this theory...if correct it would imply stocks are headed higher.

Dear techs, good luck vs. fundamentals!

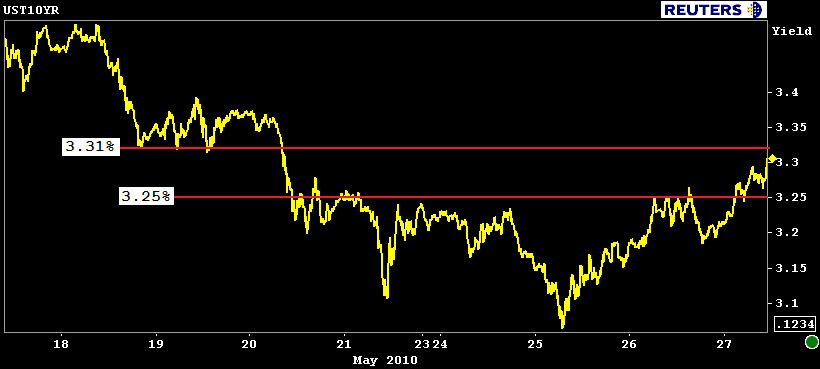

The stock lever is still the primary influence on the rates market...and higher stocks are not our friend this morning. The yield curve is steeper and benchmark 10s are down 1 point in price, +11.5bps at 3.307%. 3.31% is the next critical level of support. Then 3.37%. 5s are the weakest maturity on the spot followed closely by 7s and 10s.

10s have broken support eventhough S&Ps have yet to break through 1090 in size, added weakness is seeping into yield levels before the Treasury auctions $31 billion 7s at 1pm.

"Rate sheet influential" price levels but yield spreads are benefiting from cheaper dollar prices. The illiquid FN 4.0 is -0-15 at 99-06. The AOT friendly FN 4.5 is -0-11 at 101-31. The secondary market current coupon yield is +7.5bps at 4.132%. The CC is +81 bps over the 10yr TSY note and +72/10yr IRS. Flows are two way with money managers and hedge funds selling and real money in on lower dollars prices.

102-04 support has been broken. Mortgage rates will be worse this morning.

Again, the stock lever is not our friend today, but we're also dealing with longer dated TSY supply at 1pm. The choppy nature of the recent equity rally has not helped Treasury's fundraising efforts this week. Benchmark yields are just too low and unless S&Ps fail tests of 1090 and fall back to the lows of the day, we're due for another sloppy auction, the good thing is the pre-auction sell off helps create a concession and makes the distribution of inventory a bit easier for dealers!

You know our long term LOCK/FLOAT stance...

Thanks to a lack of liquidity in the 4.0 TBA MBS market, securitizing 4.5 and 5.0 MBS is a lender's best execution option (how do you hedge 4.0s right now? Against the long bond?) This implies it is unlikely that we see mortgage rates move any lower than current levels. Considering the amount of volatility in the marketplace and the tightly wound correlation between the stock lever and interest rates....passengers in the float boat s/be waiting it out for a shorter lock period at most. Besides that...the risk that rates rise far outweighs the minimal reward one would see if stocks sell and benchmarks rally. When/if stocks break 1090 and confirm, interest rates will move higher in a violent manner.