While a less than liquid trading environment created the illusion of volatility in the marketplace last week, the general theme was more reflective of the typical slowdown one would expect to see before a major economic event. Price action was all about investors taking profits on stock shorts and trimming Treasury longs ahead of the release of the official Employment Situation report on Friday.

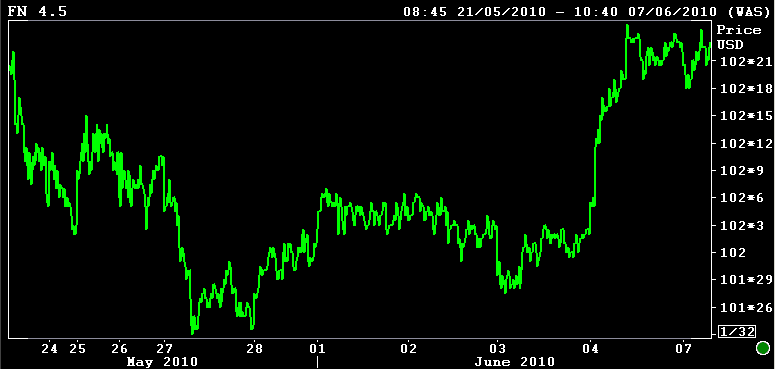

Although position squaring and profit taking led benchmark yields in an originator unfriendly direction, "rate sheet influential" MBS managed to maintain their composure. Regardless of a post-NFP TSY rally, MBS yield spreads and price levels went out at their best levels of the week....heck, the majority of the MBS stack closed near record high prices. New loan supply from originators was seen in mostly 4.5 coupons with daily offerings still running at a below average range between $1.5 billion and $2.0 billion. READ MORE

The relative stability of mortgages vs. rising TSY yields allowed lenders to keep loan pricing aggressive leading up to NFP data on Friday morning. After the NFP "disappointed" investors, lenders let out some juice and already aggressive rate sheet rebate improved to two-week highs. MORTGAGE RATE RECAP

In terms of schedule economic data, the WEEK AHEAD is less busy than the week that was...but the market's true motivational influence still seems to depend less on the health of our own economic engines than still evolving contagion conditions abroad. Besides being on constant "tapebomb" watch, interest rate traders have $70 billion in coupon supply to price. On Tuesday we get $36bn 3-yr notes, on Wednesday we get $21bn 10-yr notes, and on Thursday the Treasury will auction $13bn 30-yrs.

re: Treasury auctions and possible supply concessions (concessions generally imply lower prices and higher yields)

While auction sizes continue to trend lower and less debt supply is always a great thing for the bond market's state of mind, we are still battling greater forces, specifically the market's appetite for risk and need for adequate reward (returns).

If stocks (risk) rally and government guaranteed bonds lose their risk averse luster, Treasury traders would be glad to let these issues (only the 3-yr note is new) cheapen, especially after TSY prices were sent through the roof on Friday by a flight to safety. Read "Cheapen" as lower prices and higher yields.

Thinking about the auction cycle from the other side of the story, if stocks sell and bonds rally...

We've already witnessed the bond market turn its nose up at Treasury offerings when yields were TOO LOW (not enough reward/return). With that in mind, barring a major tapebomb disruption or another stock market selloff (thru1050), it looks like this round of auctions are set up to be sloppy either way. That doens't necessarily mean mortgage rates are doomed to tick drastically higher but the movements would not be originator friendly.

Plain and Simple: The stock lever is still the primary influence over interest rates and headline news risk (the value of the Euro currency) is the primary influence over U.S. equities. Ergo the value of a the Euro is the primary influence over interest rates. While tapebombs and impulsive non-committal reactions are the leading factors for the directional movements of interest rates, unexpected events are not guaranteed to hit screens this week. The auctioning of $70 billion in TSY coupon supply is however guaranteed to go down....and the bond market has't been able to set itself up for aggressive bidding yet. If news wires are quiet this week, this auction cycle will provide more directional guidance for interest rates.

The Euro lost more ground against the US$ last night but rebounded off the lows to retest $1.20...which failed. This is a key level of support for the Euro...if 1.20 support does not hold we will be hearing more and more discussion about Euro parity vs. the US$...which would lead to double dip debates around the globe.

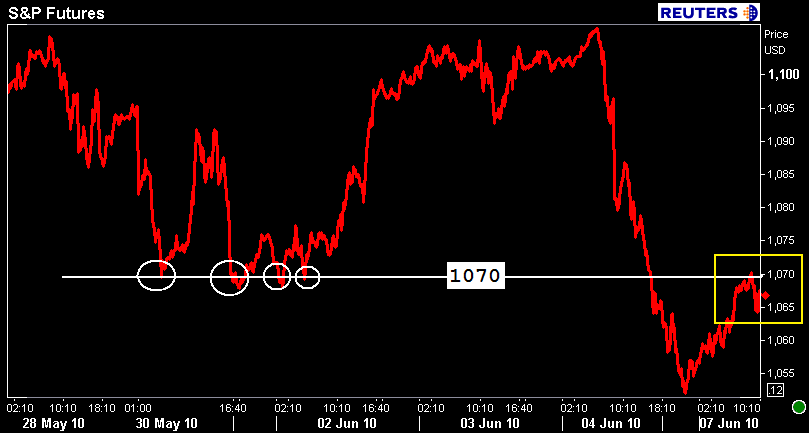

Stocks are playing follow the leader with the Euro (vs. the dollar and the Yen). S&Ps lost more ground last night but rebounded off the lows to test 1070...which failed. S&Ps are currently +1.75 at 1067.50. A failure to break 1070 would lead to a test of 1050.

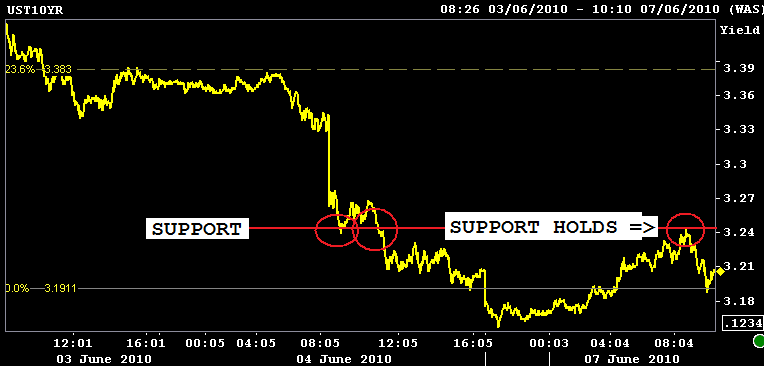

The 10 yr note is +0-02 at 102-17 yielding 3.200%. 10s failed to hold price gains that sent yields under 3.20% on Friday. This is a key layer of resistance. SEE THE CLOSE ON FRIDAY FOR CHARTS. Support was tested in the overseas session but there was no follow through in the move, after touching 3.24%, 10s promptly returned to flat on the day.

With related markets mostly range bound at the moment, rate sheet influential MBS are holding steady near record high price levels. The FN 4.0 is +0-01 at 99-29. The FN 4.5 is +0-01 at 102-23. The secondary market current coupon is less than 1bp lower at 4.027%. 3m10y vols are 2bps higher and yield spreads are off their tightest levels of the day but still improved vs. Friday.

Loan pricing is close to what was offerred on Friday.

If the Euro is doomed to tick toward parity vs. the dollar...does that mean the U.S. is destined for a double dip?

With housing teetering on a ledge and 6.7 million Americans out of a job for longer than 27 weeks...another decline in stocks will surely trigger more discussion about the potential for a "double dip". However before going that far I think we have to seriously ask ourselves if the U.S. will be dragged down with the global economic ship. While this "recovery" will not be fast and there will be times of chaos in the market...I don't feel the U.S. will be pulled into a deflationary spiral because of the Euro crisis. In the big picture, the potential of contagion spreading deeper into U.S economic sentiment will rest largely on benchmark borrowing costs. To be clear, if demand for U.S. debt is stable and interest rates are kept low (10s under 4.00%)...the U.S. consumer will continue to recover. But only to a point, eventually we have to stop cheering for low rates and hope for an improvement in domestic credit conditions.

With that in mind, if you don't believe the world is being sucked into a global great depression, when do U.S. stocks and bonds disconnect from the directional movements of the Euro? When does the opportunity cost of risk averse investing outweigh the reward? At some point investors will be forced to chase returns, they will be forced to shift funds back into higher yielding stocks.

Record low mortgage rates are only so effective if borrowers can't get a job. Seems like we are range bound for the months to come...