- FN4.5: +0-12 at 102-16

- Secondary Market Current Coupon: 4.053%

- CC Yield Spreads:+82bps/10yTSY. +72.1/10yIRS

- UST10YR: -9.2bps at 3.233%. +0-25 at 102-08. 2s performed the "least best", -6bps at 0.734%.

- S&P CLOSE: +0.44% at 1091.60. HIGH: 1092.01 LOW: 1077.49

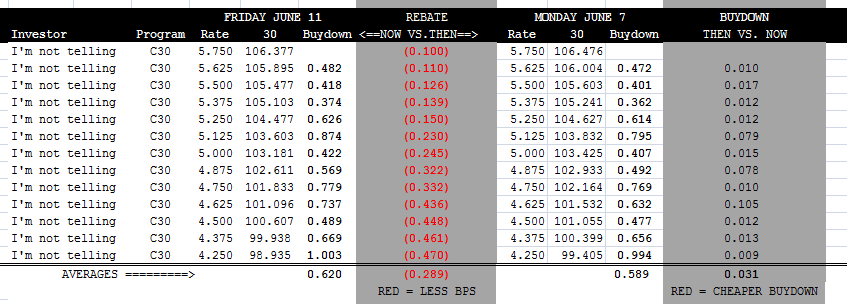

MBS performed well today, some lenders even repriced for the better. Below is grid comparing BestEx loan pricing on Monday to pricing today. On average, rebate was about 30bps lower, but most of the pain was focused in production MBS coupons. As you can see, 4.500 still pays...but it got 50bps more expensive to offer. Much of this weakness hit pricing yesterday...

READ MORE ABOUT LOAN PRICING BUYDOWNS

In an interesting turn of events, benchmark yields closed out the week totally disconnected from the directional guidance of the stock lever. Both stocks and bonds rallied into the close, but nothing was confirmed as the S&P and the 10-yr stopped short of sending new buy signals.

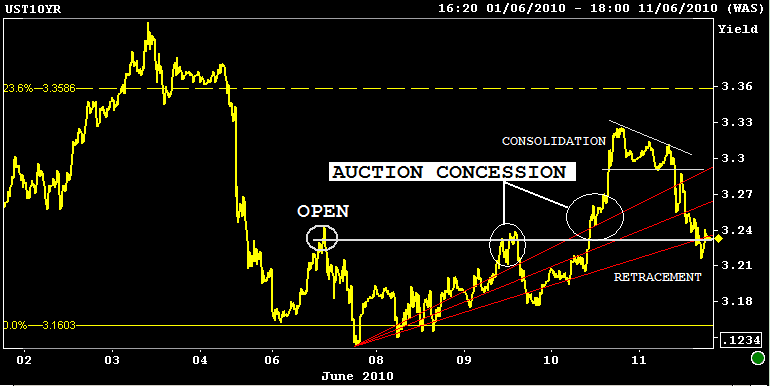

10s closed the week in the same spot they opened it, with the auction concession clearly starting the sell off that led to reprices for the worse yesterday afternoon. 10s recovered all of those losses today but failed to re-enter the recent range. This sets us up for a retest of directional sentiment on Monday.

Stocks rallied too, stopping just short of the 21 day moving average. Above 21dma resistance, the S&P faces a firmer barrier at the 200 day moving average. While I still view the S&P rally as shallow and not indicative of anything we learned from the markets this week, there is def. potential for momentum to carry the S&P toward a retest of 1107 (200dma) on Monday which of course would probably hinder further positive progress in rates. After that, it's gonna take some pretty optimistic news to get cash off the sidelines and back into the risk game. If I did have a bullish equity ax to grind, I would be watching for a rally in the Euro. This would catch market participants off-guard (pain trade). We all know what happens when the euro rallies...

The market is still acting non-committal, the biggest difference is open interest is way lower in both stock futures and 10yr TSY futures. One of these two markets is telling us it is weak and recent appreciations have not been what we think they are...

All kinds of odd happenings happening just ahead of expiration week.