I'm making an executive decision. It's time to simplify the discussion even more than we already have when it comes to what's freaking the mortgage market out. (If you're not up to speed on yesterday's news, you'll need to get caught up HERE.) Of course, "freaked out" is a relative term. After all, the average lender is offering 30yr fixed rates in the mid-to-low 3% range. How could we freak out about this?

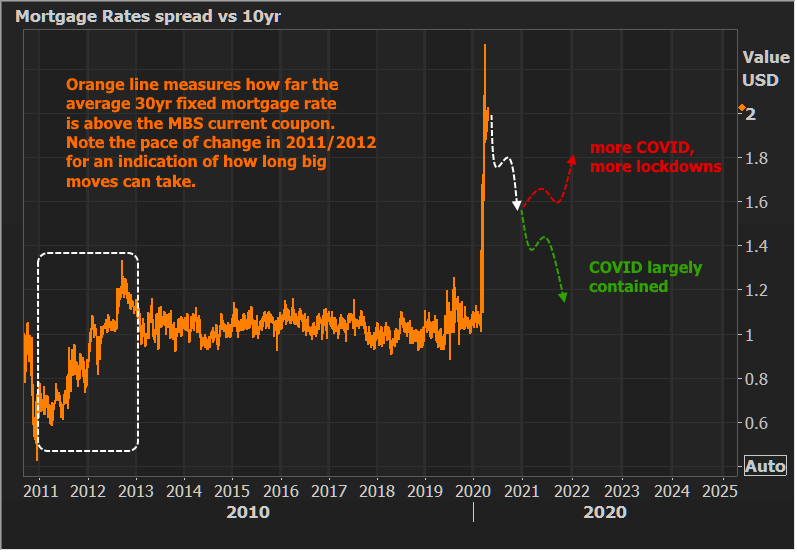

This is how: that same averge 30yr fixed rate is roughly 100bps higher versus levels implied by mortgage bonds. Moreover, that spread has been very well behaved historically--especially when it comes to rising too far above a baseline of 100bps. What could cause such a blowout?

Here's where the simplification comes in. Let's stop thinking about and talking about this in the relatively complicated context of "servicer backstops" and deep analysis of scheduled vs actual remittance types (don't worry if you don't know what that means... I'm about to say it doesn't matter). That stuff doesn't matter nearly as much as even I have led you to believe. Or rather, it's not the simplest way to understand what matters.

What matters is that the people who front the money to fund mortgages are looking at a bigger onslaught of forbearances and general economic uncertainty than they ever imagined. Let's say it's your money. You're primary source of income is making mortgage loans. The financial crisis gave you a great benchmark as to how bad things could get in the mortgage market with respect to homeowners ability to make timely payments. Now let's say that ability to pay is orders of magnitude worse due to coronavirus. In fact, you can't even really know how much worse until you see it play out because there's no relevant precedent for financial markets.

Logically, you're going to place a higher premium on the money you're willing to lend at a time like this. It's one thing for Ginnie Mae and the GSEs to set of backstops that will help make sure you get paid. But consider this: you were in a situation where you had to rely on the GSEs to make you whole if borrowers didn't pay. After yesterday, you're in the SAME DAMN POSITION. The only difference now is that your cash flow position might be better if you couldn't find a buyer willing to pay any more than 93 cents on the dollar for conforming conventional loans with disaster-related forbearance.

The only "servicer backstop" that would make a dent in lender sentiment is one that involves free money from Treasury, and there's no indication such a thing is coming. As long as it seems that lenders and GSEs can muddle through the coronavirus crisis, we'll be left to fend for ourselves.

Given all of the above, I challenge you to claim that you would quickly lower your lending rate to historical norms if you were lending your own money. At best, you are going to cautiously and gradually reapproach those norms as unknowns become knowns. The pace will depend on incoming information about coronavirus, joblessness, home values, policy-driven liquidity measures (monetary or fiscal), and forbearance uptake. If I had to scribble out a few dotted lines that spoke to the timing and pace of a generally positive and negative scenario, here's how they'd look:

In other words, it may be late 2021 before things are back to normal with respect to mortgage rates vs bond markets. How dare I pull such a conclusion out of thin air and arbitrarily place these scary line?!?!

Please... a moment... Recall that we've reduced all the recent drama to the very simple example of you being in the business of lending and servicing mortgage money. Can you rule out a resurgence of coronavirus drama heading into next winter? Can we rule out that certain states might take quarantine measures in that case (even if they're less "amputative" than the present versions)? I'm sure we both hope so. But until you have confirmation, you'd be foolish to completely lower your guard.

Bottom line, you need to see that we've moved past the point of controlling this new disease with quarantine measures that cause mass joblessness. Best case scenario, we only have to do it once, and people get back to work in greater numbers than the average gloomy forecast suggests. That's the green line scenario. Heck, it could even be a bit steeper/faster of a return to normalcy, but it's not happening next week or next month.