Following the second shallow inversion of the 2yr vs 10yr yield curve on Tuesday, 10yr yields have been surging higher while 2s recover. The curve is already back over 18bps and MBS are loving it (MBS have much shorter duration than 10s).

This process was also helped along by the general notion that this week's Fed Minutes would prove to be some sort of inflection point that would finally give the market clarity on the Fed's normalization path. That arguably happened, and it has more than a few trade desks and analysts talking more seriously about a "top" in rates. Whether that's a shorter-term or longer-term top remains to be seen. With yields hitting new multi-year highs overnight, it might be a bit too soon to celebrate.

It's not too soon to add another piece of evidence to our ongoing tracking of the reaction function surrounding the Ukraine war. Specifically: what happens when there's a marked de-escalation? There was a fresh, obvious clue overnight, and because the newswires hit at a time other than on the hour or half hour, they were very easy to separate from other potential market movers.

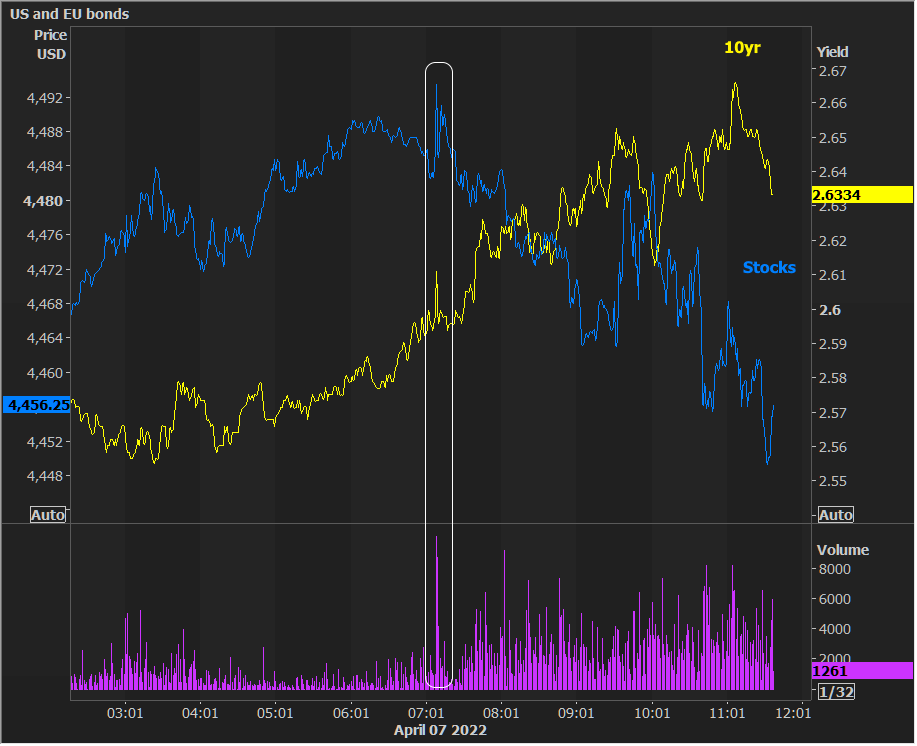

The newswires in question were fairly vague, but temporarily tradeable nonetheless. They essentially said that Russia had received a "draft peace agreement" from Ukraine. They were almost instantly walked back, so the residual market movement is non-existent. But the temporary reaction offered yet another confirmation that bonds have some selling to do and stocks have some buying to do when some semblance of peace is finally achieved. Granted, this is probably the most logical market outcome anyway, but a good reminder nonetheless.