Home prices continued to fall in November according to the S&P/Case-Shiller Home Price Indices released this morning. Both the 10-City and the 20-City Indices were down 1.3 percent in November compared to the previous month and for the second month in a row19 of the cities also saw their prices inch lower. Phoenix was the only one of the 20 to post a gain in November.

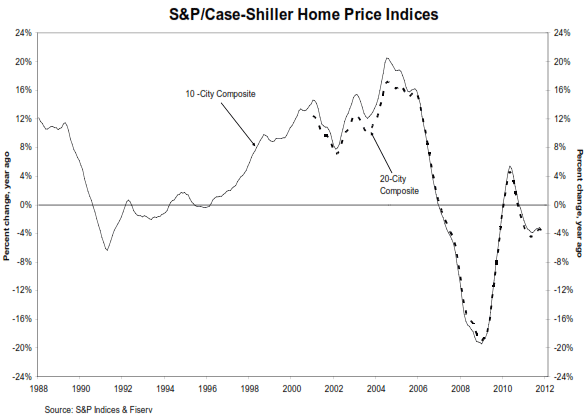

The year-over-year price declines in November widened from those in October. The 10-City and 20-City Composites were down 3.6 percent and 3.7 percent respectively from November 2010 to November 2011 compared to the -3.2 percent and -3.4 percent annual rate of change in October. Thirteen of the cities in the larger index also saw a large drop in annual prices than they had in October.

Atlanta had the worst performance with its annual return down 11.8 percent. Atlanta's prices fell 2.5 percent in November following a 5.0 percent decline in October, 5.9 percent drop in September and 2.4 percent loss in August. As was the case in October, only two cities, Detroit and Washington, DC saw an improved annual rate, but in both cases that annual increase was lower than their October number.

David Blizer, Chairman of the Index Committee at S&P Indices said, "Despite continued low interest rates and better real GDP growth in the fourth quarter, home prices continue to fall. Annual rates were little better as 18 cities and both Composites were negative. Nationally, home prices are lower than a year ago. The trend is down and there are few, if any signs in the numbers that a turning point is close at hand."

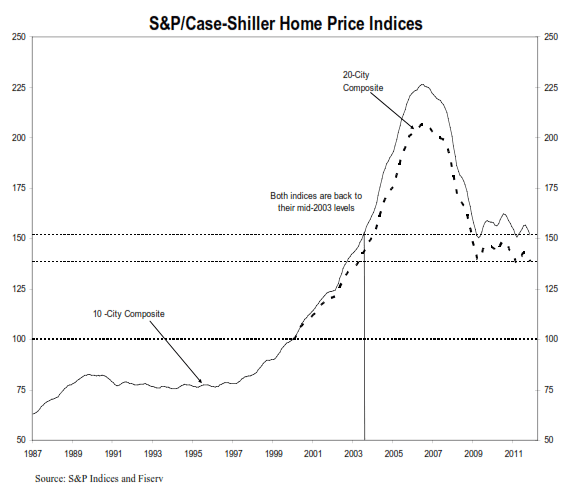

The 10-City Composite is now about 1.0 percent above its crisis low reached in April 2009 and the 20-City is 0.6 percent above the low it reached in March 2011. Both Composites are close to 33 percent off of their 2006 peak levels. As of November average home prices across the U.S. are back to mid-2003 levels.

"It's not telling us much we don't know. A lot of people fell into the trap of looking at the upturn in housing starts at the end of the year and mistaking that for a turnaround in the housing market. That's absolutely premature." - Andrew Wilkinson, Chief Economic Strategist, Miller Tabak & Co., New York.