The Center for Responsible Lending (CRL) has published a summary of the National Mortgage Settlement Agreement which makes it easy to review the details of the agreement between 49 of the states' attorneys general (AGs), the federal government and five major financial institutions and their servicing subsidiaries. While there has been a lot of publicity surrounding the settlement agreement under which the banks agreed to pay $25 billion to settle claims against them, the summary provides a thorough analysis of where the moneys are to be disbursed and the standards for servicing that have been agreed to going forward.

The settlement was occasioned by wide-spread abuses surrounding foreclosure processes used by the servicers. These were detailed in five audit reports from the Office of the Inspector General for the Department of Housing and Urban Development.

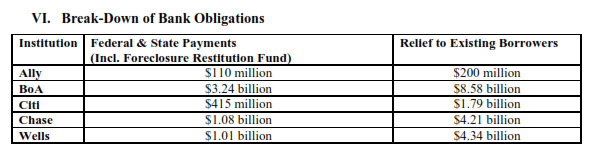

As summarized by CRL, the settlement has both cash and non-cash components. Five billion of the settlement funds will be paid in cash to the state AGs of which $1.5 billion is to be used for payments to foreclosed borrowers and for other uses to be determined by each state's AG. The summary notes that there is an intention but no requirement that those funds be used for foreclosure prevention activities such as housing counseling and legal services. Two governors, with the cooperation of their states' AGs have already announced they are diverting these funds to cover general budget shortfalls.

Individual borrowers who lost homes to foreclosure from 2008 through 2011 will be eligible for cash payments of $1,800 to $2,000. The Center describes this as one of the weakest parts of the settlement as borrowers might have to meet some difficult criteria to qualify for even this small benefit.

The remaining $20 billion is to be credited directly to borrowers by way of formula reimbursements to servicers against the costs of activities that servicers provide. At least $10 billion of this total must be used for principal reductions in loan modifications; at least $3 billion is designated for refinancing borrowers who are current on mortgages that are underwater. The remaining money, up to $7 billion will go toward other forms of relief such as forbearance for unemployed borrowers, anti-blight programs, short sales, benefits for servicemembers who are forced to sell homes at a loss due to military obligations and other programs. Servicers will not necessarily be fully reimbursed for some of these services so benefits to borrowers are expected to exceed $20 billion. The principal reduction portion might actually provide as much as $35 billion in financial relief to borrowers according to CRL.

Non-cash components include a release of claims by the AGs and some bank regulators. However, these releases are only for claims regarding servicing practices, robo-signing, and foreclosure processing and origination practices. It also releases federal civil claims based on servicing of mortgage loans and loans in bankruptcy and origination. It does not release claims of individual borrowers against servicers, criminal claims, securitization claims, and some other government claims.

The remainder of the settlement deals with reforms to the future activities of the servicers and the monitoring and enforcement of those reforms. Some of the key reforms under the agreement are:

- Ends robo-signing.

- Requires evidence of standing or right to foreclose

- Requires outreach to all borrowers potentially eligible for loss mitigation options (except those in bankruptcy) with a minimum standard for phone calls and written notices both pre-and post referral for foreclosure;

- Sets specific requirements for loss mitigation activities including restrictions on dual track processes, prompt conversion of trial modifications to permanent status, requires an offer of modification if the loan is NPV positive, and insures borrowers a right to rebut a loan modification denial.

- Short sale requests must be acknowledged within 10 days and specific offers responded to within 30 days.

- Borrowers must be provided with a single point of contact that will explain options, coordinate documents, and keep the borrower informed. This contact must have access to those with ability to stop foreclosure proceedings.

- All fees during default, foreclosure, and bankruptcy must be bona fide, reasonable, and disclosed.

- Puts some limits on forced-placed insurance including placing at a commercially reasonable price.

There are also reforms dealing with military personnel protections, blight, and tenant rights.

Enforcement of the agreement will be the responsibility of a Monitoring Committee made up of representatives from the state AGs and the Departments of Justice and Housing and Urban Development. Compliance will be overseen by Joseph A. Smith, former North Carolina Banking Commissioner, former Chair of the Conference of State Banks Supervisors and the President's nominee as Director of the Federal Housing Finance Agency. Mechanisms for enforcement will include:

- Internal quality control groups established within each servicing company;

- Specific metrics to assess servicer compliance, loan modifications, and other borrower relief activities;

- Reports from each servicer on Quarterly Compliance Reviews;

- Reports from the monitor on each servicer at least annually and only after conferring with that servicer;

- Servicers will have the right to cure any potential violations identified by the monitor;

- The Consent Judgment will be filed with the District Court and enforceable therein;

- An enforcement action that can be brought if a servicer exceeds the threshold error rate for a metric. Relief for such actions may be equitable relief or civil penalties of not more than $1 million per uncured potential violation or an amount not more than $5 million for a second uncured potential violation.