Default levels rose in all credit categories except auto loans in September according to data from S&P Indices and Experian. The month-to-month changes represented the first increases in some of the loan indices in more than a year. The increases affected four out of five regions tracked by the ratings agencies with the New York region having the most dramatic rise, going from 1.80 (all index numbers are expressed as a percent) to 2.01.

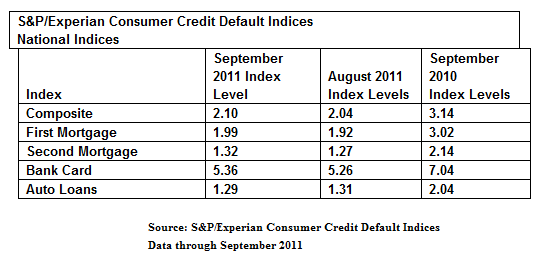

The Composite Index, which includes four loan types, first and second mortgages, credit cards, and auto loans, rose from 1.92 percent in August to 1.99 in September. In September 2010 this index was at 3.14. The index measuring first mortgage defaults went from 1.92 in August to 1.99 in September and was 3.02 a year earlier. This was the first increase in this index since November 2010. Second mortgages rose from 1.27 to 1.32 percent compared to 2.14 a year ago. The biggest change was in the bank card default rate which jumped from 5.26 to 5.36. The default rate a year earlier was 7.04. Defaults in auto loans were down from 1.31 in August and 2.04 a year ago to 1.29.

"While this is only one month of data, we have not seen so many increases in default rates in about a year or more," says David M. Blitzer, Managing Director and Chairman of the Index Committee for S&P Indices. Given the fragile state of both the economy and consumer confidence we will have to closely monitor these data over the next few months to determine if September was just a temporary blip or the reversal of the recent trend."