The Wall Street financial regulation bill won’t make it to President Obama’s desk by Independence Day as hoped. The bill passed the House last night with just three Republican votes, but a Senate vote won’t be held until after the long weekend.

Equity futures are flat this morning ahead of key labor, manufacturing, and housing data.

Ninety minutes before the opening bell, Dow futures are down 13 points to 9,703 and S&P 500 futures are down 2.50 points to 1,024.00.

The 2-year Treasury note is 2 basis points lower at 0.625% and the benchmark 10-year Treasury note is 0.2bps lower at 2.933%.

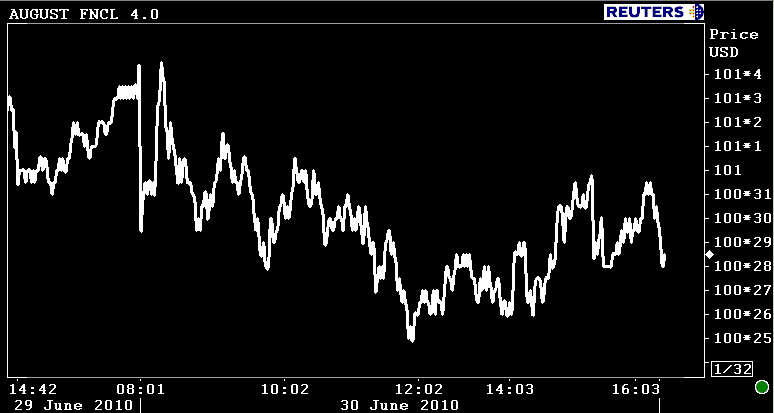

The August delivery Fannie Mae 4.0 MBS coupon has opened 2 ticks lower at 100-28. The August delivery Fannie Mae 4.5 MBS coupon is UNCH at 103-09. The secondary market current coupon is +0.004% at 3.833%.

Key Events Today:

8:30 ― Initial Jobless Claims continue to levitate above levels consistent with labor growth. In the first three weeks of June, new claims have averaged 464k per week, which is the highest level since February (weekly claims were 458k in May, 463k in April, 448k in March, and 468k in February.) Week after week, economists have predicted a 450k level ― the threshold suggesting overall growth ― but not since the week ending May 8 have they been accurate. The consensus estimate of economists surveyed by Reuters calls for 452,000 initial jobless claims today.

Economists at BTMU say the data are accurate and imply that other economists are out of touch in such forecasts.

“Recent indicators showing that the downward trend in jobless claims has stalled and business confidence is faltering suggest that April’s strong growth in private payrolls was the anomaly, as opposed to May’s weak growth,” they wrote, predicting 460k fresh claims.

10:00 ― ISM Manufacturing Index has been extremely robust in recent months. The most closely watched and influential measure of the sector hit a six-year high of 60.4 in April and only strayed downward by 0.7 points in May. Importantly, May’s employment component jumped 1.3 points to 59.8, the second highest reading since December 1983. In June the index is anticipated at 59.0, representing gradual slowdown but overall far above the 50 level indicating sector growth.

“We expect another solid performance in the manufacturing sector, albeit less ebullient than the prior few months,” said economists at IHS Global Insight. “Regional indicators suggest a modest slowing. June was a decent month, but just pales in comparison to the past few barnburners.”

Economists at BBVA said manufacturing should remain resilient.

“May’s increase in orders for durable goods excluding transportation points to further growth, as does the new orders component of May’s ISM report,” they wrote. “As a result, the ISM is expected to remain at a high level, which would point to robust growth in the industry, greater industrial production, an improvement in the industry’s employment situation and greater business spending.”

10:00 ― After existing home sales unexpectedly dropped 2.2% last week, markets will be eyeing the Pending Home Sales Index to see if a rebound is in store. Unfortunately, one isn’t expected.

“Because the federal homebuyer tax credit required that sales contracts be signed by the end of April, the May pending home sales index should show a very sharp decline in activity,” said economists at Nomura.

The PHSI tracks sales contracts that have been signed but not yet finalized, thereby acting as a leading indicator for existing home sales.